What is Single Touch Payroll (STP)?

STP Definition

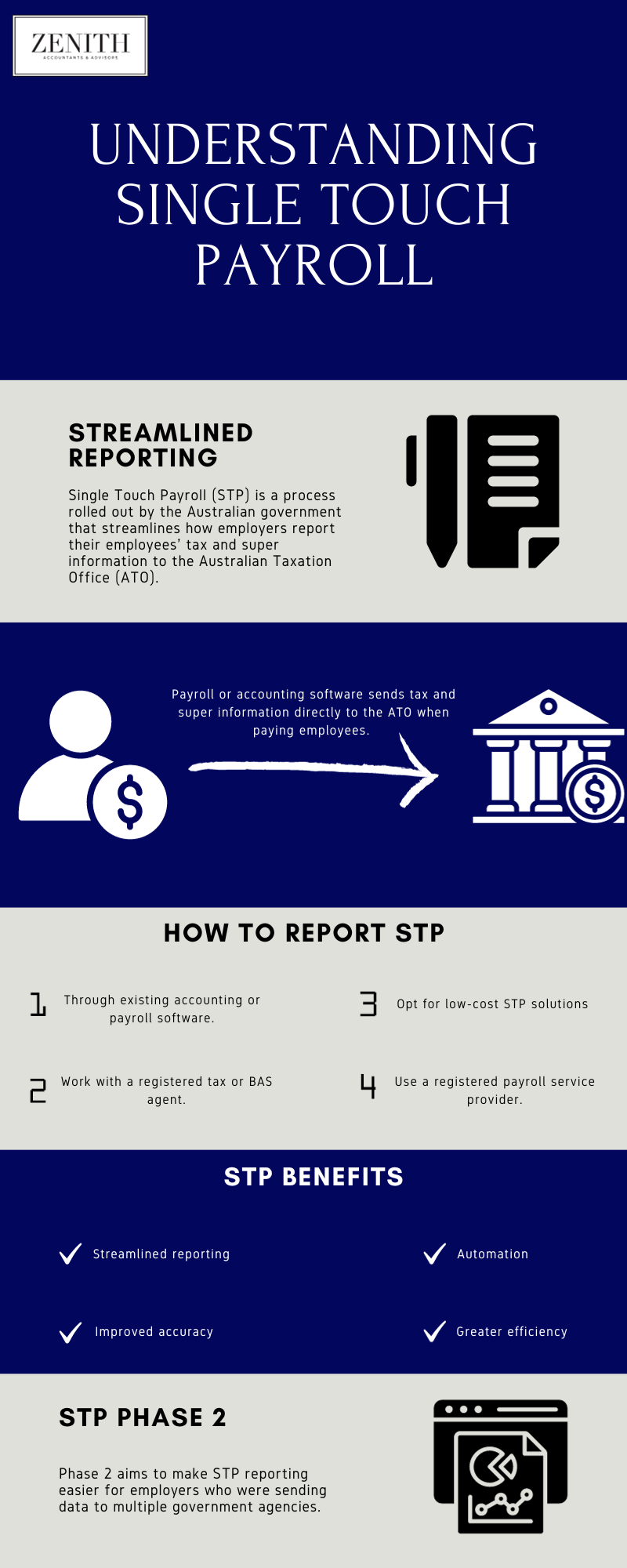

Single Touch Payroll (STP) is a process rolled out by the Australian government that streamlines how employers report their employees' tax and super information to the Australian Taxation Office (ATO). It allows employers to send their employees' payroll information, including salaries, wages, PAYG withholdings and superannuation, to the ATO each time they run their payroll and pay their employees.

Key Dates

1 July 2018: Single Touch Payroll started for larger employers with 20 or more staff.

1 July 2019: Single Touch Payroll started for employers with 19 or fewer employees and became a mandatory obligation.

1 January 2022: STP Phase 2 was rolled out, requiring additional payroll information to be reported.

Current: All employers should be reporting through Single Touch Payroll and moved to STP Phase 2.

How STP Works

Single Touch Payroll was designed so payroll systems or accounting software would send tax and super information to the ATO when paying employees.

As an employer, you will run your payroll like normal, pay your employees like normal and provide them with a payslip. The software you use will then send the ATO a report that includes the relevant information, including:

- PAYG withholding

- Super liability information

- Employee wages or salary

- Remuneration to the directors of a company

- Unused leave payments

- Parental leave payments

- Return-to-work payments

- Termination payments

How To Report STP Data

When it comes to STP reporting, there are a few ways employers can send the required information:

- Through existing accounting or payroll software. This option will send the report directly to the ATO. It's important to ensure your software is STP-enabled.

- Work with a registered tax or BAS agent like Zenith Accountants & Advisors. They can send the reports on your behalf.

- Opt for low-cost STP solutions (for businesses with fewer employers of 1-4 people). Specific payroll software has been developed for small businesses.

- Use a registered payroll service provider.

When submitting STP reports, the ATO will match the information to your employer and employee records.

Employees that have a myGov account linked to the ATO, will have access to their tax and super information that's included in their employee's income statement.

As an employer, you will need to finalise your STP data at the end of the financial year.

Once you have finalised your STP information, employees will see their income statement in the ATO online services marked as 'Tax Ready'. They can then lodge their tax return.

It is no longer a requirement to provide employees with payment summaries or provide the ATO with a payment summary annual report thanks to STP reporting.

What is STP Phase 2?

During the 2019-20 budget, the Australian government announced that Single Touch Payroll would need to include additional information from 1 January 2022 - this was called STP Phase 2. It aims to make STP reporting easier for employers who were sending data to multiple government agencies. It also ensures Services Australia customers are paid the correct amount at the correct time.

Benefits of STP Phase 2

Phase 2 of STP offers a more efficient model for employers and employees. For example, sending tax file number (TFN) declarations has shifted from employers to employees and some reporting can now be directly communicated via the STP report.

Benefits for Employees

Phase 2 ensures a smoother experience for employees, particularly during tax time. The ATO's collaboration with Services Australia means quicker, more streamlined processes for all involved parties.

When is Single Touch Payroll Not Required

There are a few examples where you are not required to submit STP reporting, such as when you close your business, change your business structure or are no longer making employee payments.

How to choose the right Single Touch Payroll Software

When selecting a STP software, prioritise your business size and specific needs, ensure it integrates with existing systems, offers robust security and updates for compliance. You should also consider its user-friendliness, cost, scalability and customer support.

Simplify Your STP Reporting with Zenith Accountants & Advisors

Understanding payroll information, accounting software and ATO compliance is no easy feat. At Zenith Accountants & Advisors on the Gold Coast, we work with

businesses of all shapes and sizes to ensure they are using STP-enabled payroll software and understand how it works. From setting up the software to

lodging your tax return, our professional accountants will help you navigate the complexities of Single Touch Payroll. To book a consultation, get in touch today.

Written By Tom Thynne

Tom is the director of Zenith Accountants & Advisors. With over seven years of public practice experience, Tom can see what it takes to make a business successful. Tom is a Chartered Accountant, Financial Planner, Registered Tax Agent and Certified Advisor in QuickBooks Online and Xero.